[ad_1]

- The stock market has had a good year so far but is currently heading lower

- And Michael Burry has decided to short the market

- Will this be another ‘big short’ for Burry or just another failed prediction?

Everyone knows by now that Michael Burry has decided to take a billion-dollar bearish bets against the and the , as shown on his latsest 13 filing. According to the document, Scion Asset Management purchased $866 million worth of puts against the SPY and $739 million worth of puts against the QQQ, exposing over 90% of its portfolio.

But despite gaining fame for ‘The Big Short’ and his assessment of the 2008 housing market, Michael Burry is also known for firing blanks. He frequently retracts his inaccurate forecasts. In fact, since 2015, the S&P 500 has actually posted positive performances after each one of Burry’s bearish prognostics.

Here’s the list:

- In December 2015, he predicted a stock market crash in the following months, but the S&P 500 saw an 11% gain in the subsequent 12 months.

- In May 2017, he predicted a new financial collapse, yet the S&P 500 recorded a 19% increase in the following 12 months.

- In September 2019, he forecasted a stock market crash due to an “indexed ETF bubble,” but the S&P 500 gained 15% in the next 12 months.

- In March 2020, he perpetually held a bearish view, but the S&P 500 surged by 72%.

- In February 2021, he predicted significant stock market declines due to a speculative bubble, yet the S&P 500 increased by 16% in the subsequent months.

- In September 2022, he forecasted further failures and that the lows hadn’t been touched, but the S&P 500 performed positively with a 21% gain.

- In January of this year, he foresaw a recession and a new cycle of inflation, yet the S&P 500 achieved remarkable positive performance.

With this in mind, let’s take a peek at history for some insights on whether the ‘Big Short’ investor is right this time around.

S&P 500’s High-Return Years

Since 1928, the S&P 500 has ended the year positively with a +10% (or more) gain a whopping 55 times. Yet, within those positive years, there were 23 instances of a correction of -10% (or worse).

Additionally, during the same time frame (up until now), the stock market has had 34 years of +20% (or higher) positive performance. Still, that didn’t prevent it from encountering a -10% (or deeper) correction along the journey.

Check out these years when S&P 500 annual performance was +20% or more:

- 1933: Returns +50.0%, Correction -29.4%

- 1935: Returns +46.7%, Correction -15.9%

- 1928: Returns +43.8%, Correction -10.3%

- 1975: Returns +37.0%, Correction -14.1%

- 1997: Returns +33.1%, Correction -10.8%

- 1955: Returns +32.6%, Correction -10.6%

- 1936: Returns +31.9%, Correction -12.8%

- 1980: Returns +31.7%, Correction -17.1%

- 1950: Returns +30.8%, Correction -14.0%

- 1938: Returns +29.3%, Correction -28.9%

- 2003: Returns +28.4%, Correction -14.1%

- 1998: Returns +28.3%, Correction -19.3%

- 2009: Returns +25.9%, Correction -27.6%

- 1943: Returns +25.1%, Correction -13.1%

- 1999: Returns +20.9%, Correction -12.1%

- 1982: Returns +20.4%, Correction -16.6%

But this year, the biggest dip the index faced was only around -8% (between February and March). So, relatively speaking, we’re experiencing milder corrections.

Keep in mind: stocks can be wild and unpredictable, a bit like the twists and turns in a rollercoaster, all driven by investors’ impulsive decisions.

Let’s also remember that in the second half of the previous year, things were rosy for everything except tech stocks, which had a bit of a rough patch. Then the market shifted its focus towards tech and larger-cap stocks.

So what’s the market’s next move? It’s a fascinating puzzle to solve, especially considering the fact that Michael Burry has decided to short the market. When compared to the S&P 500, the tech sector (NYSE:) has been moving sideways for several months, having broken its uptrend. The RSI confirms the tech weakness, but history shows they might regain momentum, just as they’ve done before.

When compared to the S&P 500, the tech sector (NYSE:) has been moving sideways for several months, having broken its uptrend. The RSI confirms the tech weakness, but history shows they might regain momentum, just as they’ve done before.

Interestingly, it seems the situation might be even worse compared to the energy sector (NYSE:). After 2020, the Energy sector has been one of the major underperformers this year, and it’s been outperforming the tech sector in the last month. Once again, the RSI confirms the weakness in the tech sector.

After 2020, the Energy sector has been one of the major underperformers this year, and it’s been outperforming the tech sector in the last month. Once again, the RSI confirms the weakness in the tech sector. Energy, compared to the growth index (NYSE:), is showing a positive turnaround, reclaiming the levels from March 2023.

Energy, compared to the growth index (NYSE:), is showing a positive turnaround, reclaiming the levels from March 2023.

This weakness is a crucial insight for anyone analyzing the markets, given that technology and big-cap companies make up over 30% of the S&P 500. So, if they are facing a temporary difficulty, it could translate to challenges for the index itself.

So, is it over for the Tech sector?

I don’t believe so, but these observations suggest that something might be shifting. The S&P 500 and Invesco DB Energy Fund (NYSE:) ratio has once again encountered resistance, pushing back the outperformance of the US index compared to the energy index.

The S&P 500 and Invesco DB Energy Fund (NYSE:) ratio has once again encountered resistance, pushing back the outperformance of the US index compared to the energy index.

Meanwhile, the stocks comprising the index have turned lower after reaching the highs of 2021 and encountering resistance from the previous cycle. However, this doesn’t mean history will repeat itself; the decline in 2021 happened under different circumstances. But in the upcoming weeks, keeping an eye on market movements and their direction will be crucial.

However, this doesn’t mean history will repeat itself; the decline in 2021 happened under different circumstances. But in the upcoming weeks, keeping an eye on market movements and their direction will be crucial.

In fact, realistically, I don’t think that this latter scenario has a very high likelihood before the end of the year or possibly even at the beginning of 2024.

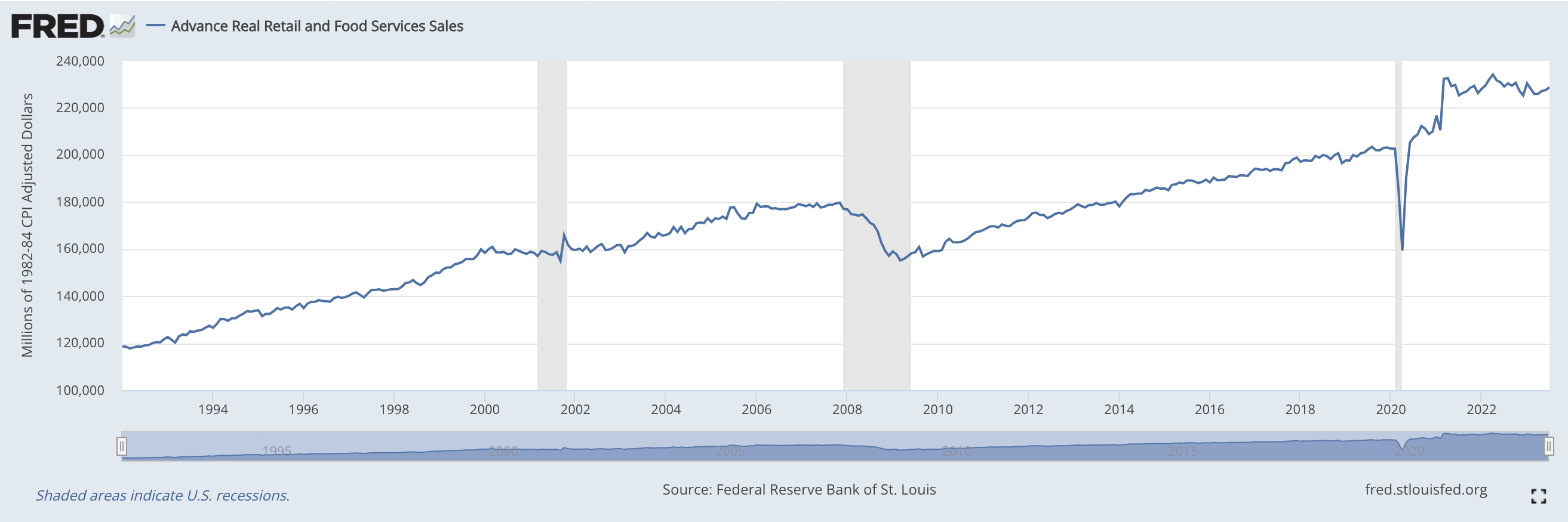

In July, the US data showed a -0.12% decline, establishing a two-year sideways trend that has previously been associated with an economic recession. The US retail sales report provides crucial insights into the performance of retail trade, both in large and small businesses. This indicator is closely followed by economists and financial market investors as it signals the trends in consumer demand.

The US retail sales report provides crucial insights into the performance of retail trade, both in large and small businesses. This indicator is closely followed by economists and financial market investors as it signals the trends in consumer demand.

Given that around 70% of the US GDP is attributed to personal consumption, any sideways movement in this data needs to be closely monitored.

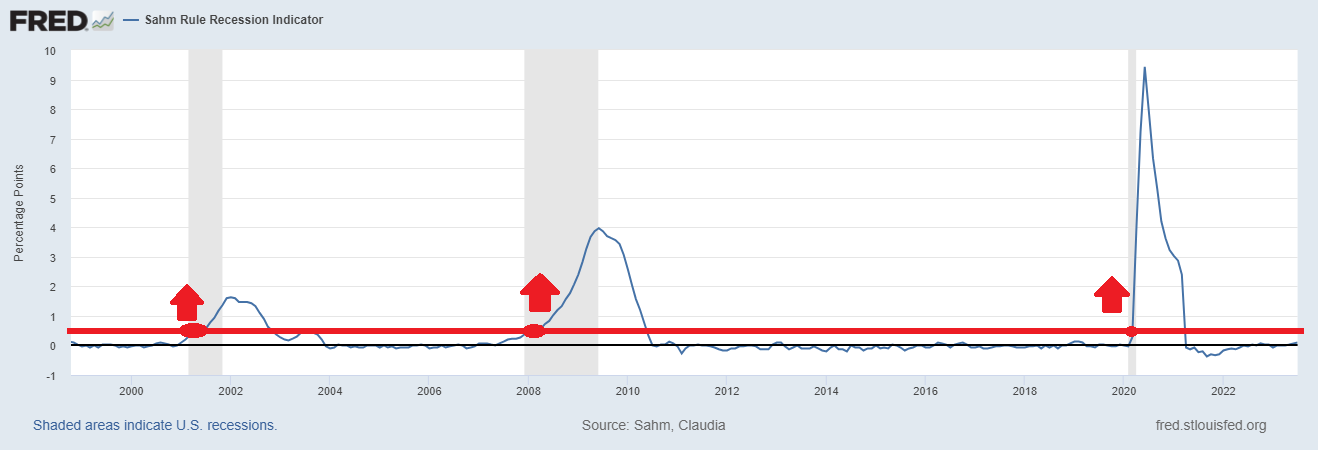

Furthermore, there’s the Sahm indicator, which suggests that the economy tends to enter a recession when the quarterly moving average of the increases by 0.5% compared to the lowest point of the preceding 12 months.

Born in 2019 from a study by Federal Reserve economist Claudia Sahm, this indicator is perhaps the closest we have to a real-time recession monitor, although typically, the National Bureau of Economic Research takes about a year to officially declare a recession. Currently, the quarterly moving average of the unemployment rate has only increased by 0.1% compared to the year’s low, far from the 0.5% threshold that indicates a recession.

Currently, the quarterly moving average of the unemployment rate has only increased by 0.1% compared to the year’s low, far from the 0.5% threshold that indicates a recession.

From the chart, we can observe that unemployment often reaches a cyclical low before a recession, only to surge above 4% during the downturn. Currently, it stands at 3.5%, near the lowest point in the past 50 years. Could this suggest a recession in the coming months?

So will Burry, who revealed his short position on the market a few days ago, be right this time, or will he fire another blank?

Only time will tell. But history may not be on his side this time around.

***

Disclaimer: This article has been written solely for informational purposes; it does not constitute a solicitation, offer, advice, consultation, or recommendation for investment, nor does it intend to encourage the purchase of assets in any way. Please note that any type of asset is evaluated from multiple perspectives and carries high risk. Therefore, every investment decision and its associated risks are the responsibility of the investor.

[ad_2]

Source link